We’ve helped thousands of clients get where they want to be through our personalized approach to self-storage advisory services. Our knowledgeable team of self-storage brokers has helped buyers and sellers find success investing in the self-storage market, regardless of their situation or setting.

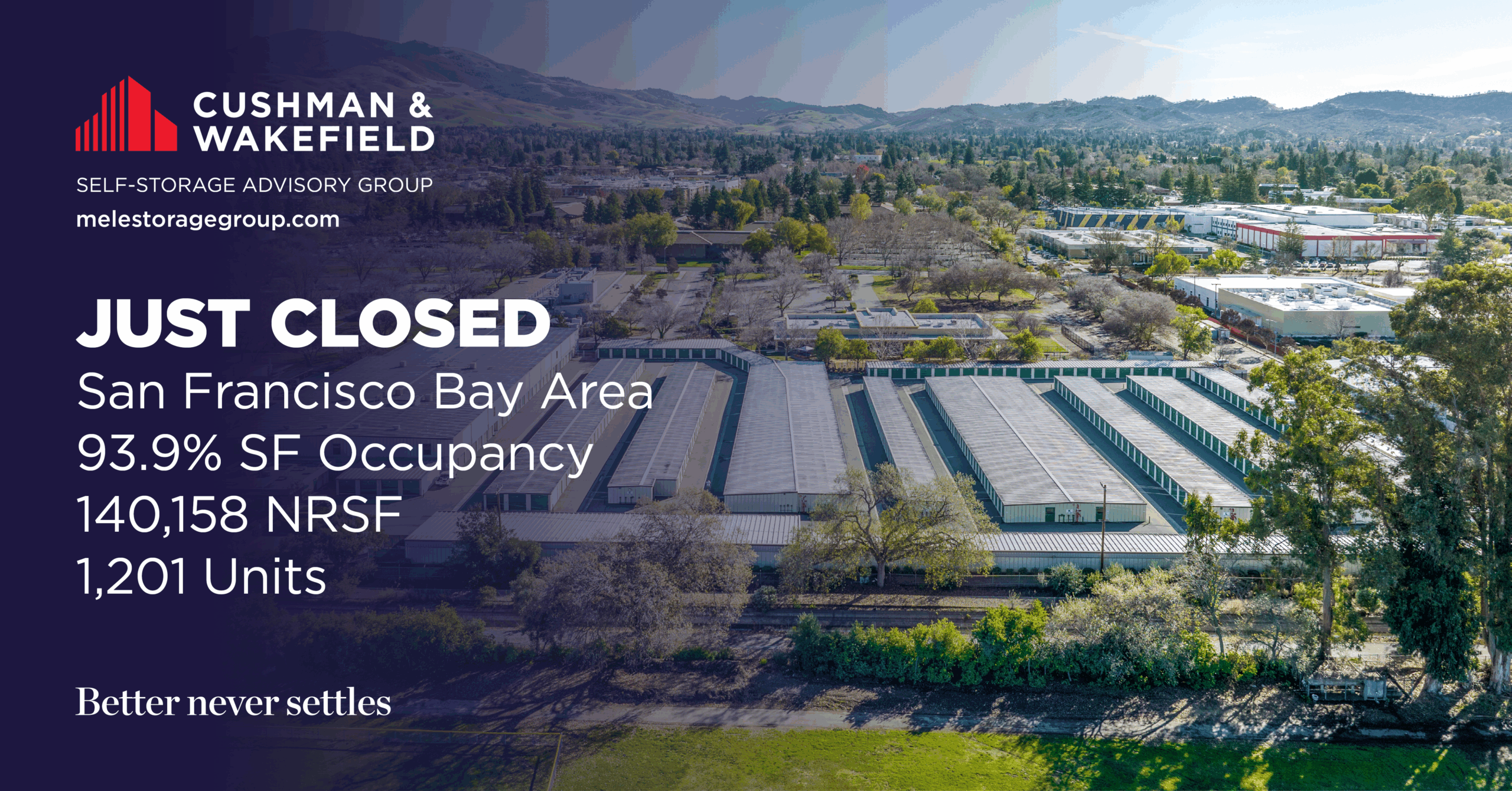

Cushman & Wakefield’s Self-Storage Advisory Group successfully closed on the sale of Shadelands Self Storage, a premier, self-managed facility located in the affluent Walnut Creek submarket of San Francisco’s East Bay. Strategically positioned between Treat Boulevard and Ignacio Valley Road, the property offers exceptional visibility and accessibility to the surrounding communities of Pleasant Hill, Concord, and Clayton. The facility spans over 140,000 rentable square feet across 1,201 units, featuring a highly desirable unit mix with 62% drive-up units and nearly 83% ground-level access—a rarity in dense infill markets.

The Cushman & Wakefield team cultivated a long-term relationship with the ownership group. This groundwork led to a formal engagement to market the asset. The campaign generated robust interest and multiple competitive offers. However, the seller initially paused the transaction to pursue a 1031 exchange, which ultimately did not materialize. Upon re-engagement, the team reconnected with top prospective buyers and successfully resumed the transaction process. During due diligence, shifting market conditions and the start of a new adjacent development caused some buyer concerns. Through persistent communication and skilled negotiation, the Advisory Group maintained buyer engagement and guided the deal to a successful close.

Despite market volatility and the emergence of a competing facility directly adjacent to the site, Cushman & Wakefield closed the transaction on strong terms. Navigating a paused 1031 exchange, re-engaging original bidders, and managing evolving buyer expectations required strategic coordination and proactive communication. The property’s institutional-quality design, strong occupancy, and irreplaceable location in an affluent submarket reinforced its long-term investment appeal. Shadelands Self Storage stands as a best-in-class asset with operational upside and durable fundamentals, making it a highly attractive acquisition for institutional capital.

Cushman & Wakefield’s Self-Storage Advisory Group (CWSSAG) was exclusively engaged to represent the sale of 1st Ave Self Storage, a 17,182 SF, three-story Self-Storage facility located in Seattle’s highly visible and industrial SODO district. The property consists of 202 climate-controlled storage units, a manager’s office, and 44 mailboxes, situated on a compact 0.2-acre parcel directly across from Starbucks Corporate Headquarters and within walking distance of both T-Mobile Park and Lumen Field.

At launch, the facility was 57% occupied by units and 69% occupied by square footage, offering a clear upside through more sophisticated operational strategies and marketing efforts. With strong drive-by exposure on 1st Ave (15,000+ vehicles daily) and just minutes from downtown Seattle, the asset sits in a dense, undersupplied trade area featuring 4.34 NRSF per capita within a three-mile radius.

CWSSAG approached the owner through a cold call in early 2024, identifying the asset as a strong candidate for strategic disposition. At the time, the owner had been exploring the market but had not formally listed the property. Following multiple discussions and a detailed Broker Opinion of Value, we brought the property to market in the fall with a pricing guide near $5 million.

However, despite strong initial interest, feedback from the market identified a key pricing disconnect. While the location and upside were appealing, the relatively low occupancy combined with a disproportionate share of income derived from U-Haul truck rentals and merchandise sales—rather than core storage revenue—was viewed as a significant drawback by most buyers. These non-traditional income streams contributed to underwriting hesitation and made the original pricing difficult to support.

CWSSAG worked closely with the owner to reposition the offering by adjusting pricing expectations in response to real-time market feedback. This pricing discovery process and re-engagement with active buyers ultimately renewed market momentum.

Following the adjusted pricing strategy and refreshed market push, CWSSAG successfully generated three offers on the asset. A best and final process was conducted to identify the most qualified and competitive buyer. Merit Hill emerged as the preferred group, ultimately securing the deal at $4.2 million.

The transaction proceeded smoothly through due diligence and closing, highlighting CWSSAG’s ability to adapt quickly to market conditions and guide sellers through nuanced pricing conversations—especially when non-traditional income streams and lease-up dynamics create additional complexity.

This case underscores the power of strategic positioning, data-driven pricing, and focused buyer outreach in maximizing value for infill storage assets with strong long-term fundamentals.

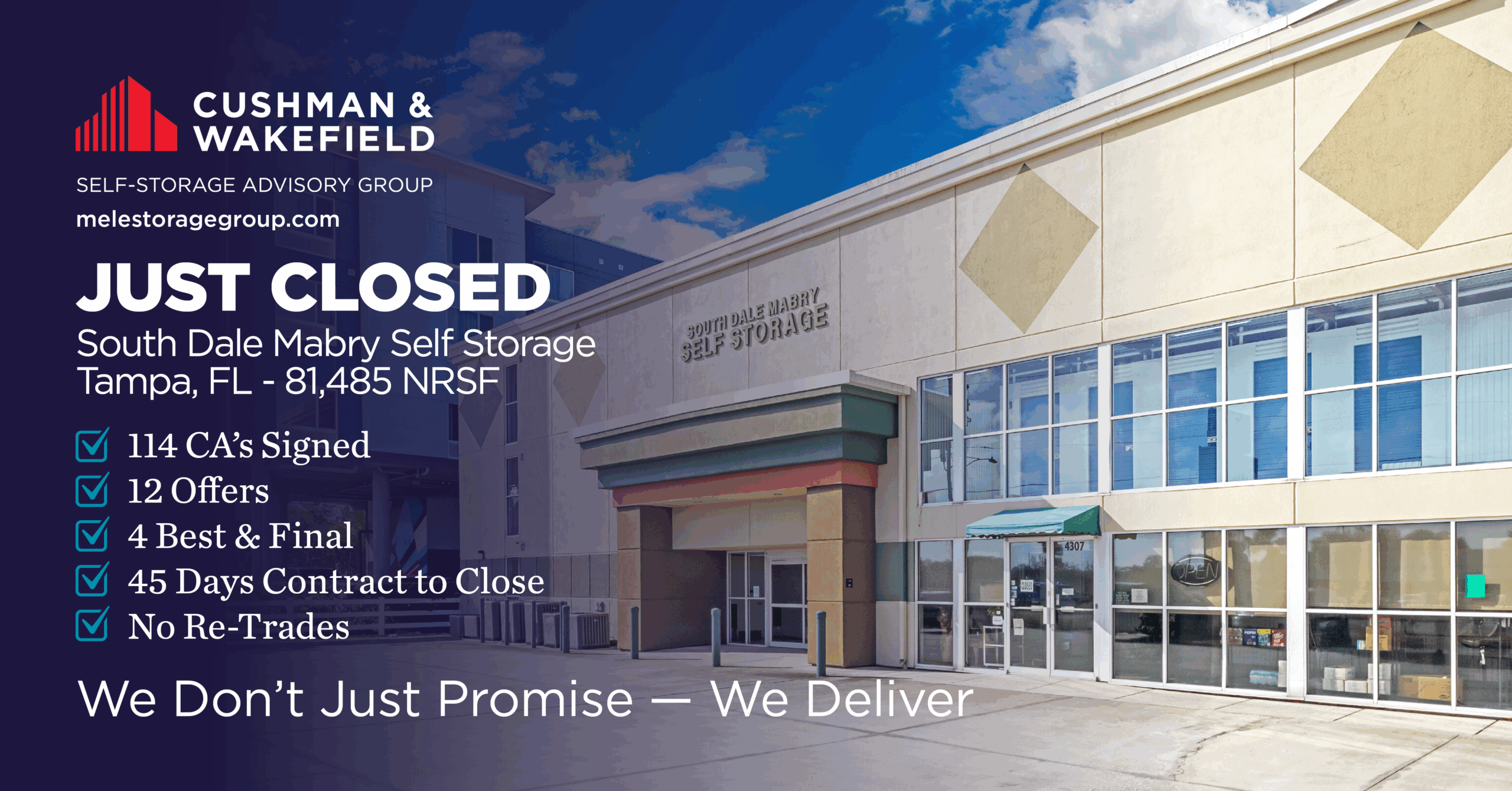

Cushman & Wakefield’s Self-Storage Advisory Group was exclusively retained to market South Dale Mabry Self Storage, a high-quality, owner-managed facility located in the South Tampa submarket of Tampa, Florida. Originally built as a warehouse and converted to self-storage in 2001, the property underwent two expansions, including a three-story climate-controlled addition in 2019. The facility comprises 81,485 net rentable square feet across 826 climate-controlled units and 35 parking spaces. Situated on South Dale Mabry Highway, just north of Gandy Boulevard, the asset benefits from excellent visibility, limited competition in its immediate trade area, and proximity to ongoing residential and commercial redevelopment. At the time of marketing, the property was 99% occupied with in-place rents approximately 20% below market, offering clear operational upside as well as additional expansion potential on the western portion of the site.

Cushman & Wakefield launched a comprehensive marketing campaign targeting a broad range of institutional, regional, and private investors. The team emphasized the property’s prime infill location, stabilized occupancy, and significant rent growth potential. Investor engagement was strong, with 114 confidentiality agreements executed and 12 offers submitted. Four groups were selected for a best and final round. During diligence, the team effectively managed physical and environmental review items, coordinating closely with all stakeholders to preserve deal momentum and ensure a smooth path to closing.

The transaction closed in 45 days from contract execution with no retrades. The high level of interest, combined with the quality of the final buyer pool, validated the asset’s positioning as a top-tier self-storage opportunity in the Tampa market. Cushman & Wakefield’s proven process delivered a strong outcome, highlighting the team’s ability to generate competitive bidding, resolve diligence challenges, and provide a seamless closing experience in a dynamic market environment.

Cushman & Wakefield’s Self-Storage Advisory Group was exclusively retained to market a Class-A U-Stor-It managed facility located in Vista, California. Delivered in 2021 through the conversion of an industrial building, the property comprises 112,790 net rentable square feet across 1,280 fully climate-controlled units. The facility was 89% physically occupied at the time of marketing and approaching stabilization. Positioned in a high-growth, high-income corridor—with a 3-mile population of 139,024 and average household income of $128,151—the asset benefits from strong residential demand, minimal nearby supply, and significant revenue growth potential through continued lease-up and rent optimization.

One of the primary challenges in the marketing process was the presence of new supply entering the immediate trade area, raising concerns around market rent durability and future lease-up velocity. Leveraging its in-depth local market expertise, Cushman & Wakefield effectively contextualized the property’s performance by highlighting nearby residential growth, true market occupancy trends, and the facility’s below-market in-place rents. As a late-stage lease-up, the facility had reached nearly 90% physical occupancy within 24 months of delivery but still required significant revenue growth to meet investor return targets—particularly difficult in a high-interest rate environment. This limited the buyer pool to those prepared to assume bridge debt under less favorable terms or transact all-cash. Additionally, late in the escrow process, recent changes in California environmental regulations triggered new inspection requirements. The Cushman & Wakefield team worked closely with both parties to navigate the regulatory updates and maintain deal momentum, ultimately driving the transaction to a successful close.

Through the Cushman & Wakefield Self-Storage Advisory Group’s targeted marketing process, the team successfully positioned the Vista facility to a broad range of institutional, regional, and private investors. The campaign generated strong national interest, with 131 confidentiality agreements signed across 18 states and a total of 9 offers submitted. An all-cash institutional buyer with an experienced operating partner was ultimately selected. Despite headwinds related to new supply and evolving environmental regulations, the team navigated these complexities to ensure a smooth and timely closing in January 2025.

Cushman & Wakefield’s Self-Storage Advisory Group (CWSSAG) has been named the exclusive advisor for the sale of the McDonough Class-A Self Storage Opportunity in Georgia. Built in late 2022, this three-story, Class-A facility spans 77,085 NRSF and features state-of-the-art technology and security systems. It offers a variety of 702 units across its three floors. Impressively, the facility has achieved an 83% occupancy rate of rentable square feet by the end of August, less than a year after opening. The facility is located on Jonesboro Road, a bustling route through McDonough with an average daily traffic of over 33,000 vehicles. Less than a mile away, Interstate 75 offers easy access to downtown Atlanta. In October 2023, Foundry Investment Group enlisted CWSSAG to market this asset, with the goal of reallocating capital for future development projects.

Launched at the start of Q4 in 2023, the market was sluggish, compounded by the fact that the property was in the late stages of lease-up and not yet physically or economically stabilized. The market remains challenging for lease-up and Certificate of Occupancy (CofO) properties due to how buyers are underwriting stabilized rental rates, both in terms of timeline and the figures used, as well as the financing costs for acquisitions. It was not an ideal time to introduce a property in the late stages of lease-up, resulting in limited traction. It became apparent upon the first wave of offers that the market would not be able to meet the targeted price for this asset.

Through the extensive marketing efforts of the Mele Group, our team successfully showcased this Class-A asset to targeted buyer groups who recognized the potential of Atlanta’s growing McDonough submarket. Collaborating with the seller, we devised a plan to improve the numbers and achieve our goals. Leveraging existing relationships, the Cushman and Wakefield Self-Storage Advisory Group attracted offers from various interested buyers. After a thorough three-round bidding process, DWS RREEF emerged as the preferred buyer. The transaction, from negotiations to due diligence and closing, proceeded seamlessly and efficiently.

Cushman & Wakefield’s Self-Storage Advisory Group (CWSSAG) was exclusively retained by Poverni Sheikh Group (Client) to market for sale the Extra Space Storage in Baltimore, Maryland. Constructed in 2019, the multi-story, Class-A facility encompassed 77,003 NRSF and featured state-of-the-art technology and security. It included 820 climate-controlled units and permits for an additional 54 drop-in unit expansion. This prime location attracted Gen Z and Millennials, with adjacent fully leased Class-A retail space and over 1,000 recently delivered Class-A apartments. The 3-mile trade area boasted a population of 157,800 with a median household income of $105,687. Poverni Shiekh Group engaged CWSSAG to bring this asset to market in mid-May 2021, marking the conclusion of a development JV and a transition to new projects for both partners.

Despite the subject property’s prime location in Canton, Baltimore faces limited appeal to core funds, private equity, and family offices due to ongoing demographic challenges and a negative net migration trend. Baltimore has experienced a net population loss in recent years, with a decline of approximately 5.4% from 2010 to 2020, primarily driven by outmigration to surrounding areas and states with more robust job markets. Additionally, in-place rents at the subject property were materially higher than the current market asking rents, which caused some further hesitation from the investment market.

The Cushman & Wakefield Self-Storage Advisory Group (CWSSAG) effectively marketed the opportunity to over 3,000 investors, resulting in 62 executed confidentiality agreements and data room downloads. Addressing buyer concerns, the team emphasized the Canton neighborhood’s strength, the asset’s quality and strategic positioning, and the potential for value enhancement through NOI growth initiatives. These efforts led to 13 bids on the property, with some groups significantly exceeding initial pricing expectations. Following a rigorous three-round bidding process, Morningstar Properties emerged as the successful bidder due to its ability to compress diligence and closing timelines. The Extra Space Storage in Canton, MD, was successfully traded in July 2024, surpassing price expectations by 2.1% and promptly.

Cushman & Wakefield’s Self-Storage Advisory Group (CWSSAG) was exclusively retained by Noble Family Enterprises (Client) to offer for sale CubeSmart Self-Storage in Osprey, FL. This premier, multi-story, class-A facility, constructed in 2022, spans 72,391 NRSF and is equipped with state-of-the-art technology and security features. The facility comprises 162 first-floor climate-controlled units, 559 elevator-accessible climate-controlled units, 16 drive-up units, and permits for 9 uncovered boat and RV parking spaces. Positioned along Tamiami Trail, the property benefits from high visibility with an average annual daily traffic volume of 42,500. Noble Family Enterprises selected the CWSSAG to bring the asset to market in mid-January 2024, aiming to recycle capital for future development projects.

Twelve months before bringing the asset to market for sale and throughout the marketing period, this newly constructed asset struggled to achieve more than 50% occupancy. The local market had become oversaturated with four existing self-storage facilities, two of which were built in the last two years, alongside four more planned developments. The population density could not absorb the new supply in the short term, particularly given one competitor’s aggressive efforts to significantly drop rental rates to achieve a rapid lease-up. These factors led to buyer hesitation, driven by concerns over historical lease-up challenges, an already saturated development pipeline, and concerns about stabilized occupancies and rental rates.

The Cushman & Wakefield Self-Storage Advisory Group (CWSSAG) showcased the opportunity to over 2,850 investors, culminating in 46 executed confidentiality agreements and data room downloads. In addressing concerns from buyers, the team highlighted in-place rents as a benchmark for where rates would stabilize, emphasizing that the asset could be acquired at an attractive basis near replacement costs. CWSSAG’s efforts led to multiple offers and enabled them to leverage existing relationships to find a buyer committed to implementing a new business strategy for leasing the asset. Merit Hill Capital was selected as the buyer, and the negotiations, due diligence, and closing process proceeded smoothly. The Osprey, FL Opportunity successfully transacted in June 2024, within the expected trading range initially presented to the client.

We were selected to exclusively market for sale the Memphis MSA Portfolio. The Memphis MSA Portfolio is comprised of eight facilities across 490,187 NRSF. The portfolio contains 296 climate-controlled units, 3,186 non-climate-controlled and drive-up units, 384 boat/RV parking spaces and one commercial office space, for a total of 3,867 units.

The seller, a private equity group based in Brooklyn, N.Y., approached us to sell part of its portfolio. Our team laid out a strategic plan spanning the next six months. Each property had recently completed various capital improvements — including unit conversions, painting and LED retrofitting — effectively upping their value and making them more appealing to potential buyers who could now charge more per unit.

After going under contract in January 2020, the transaction faced multiple hurdles due to the effects of the economy as a result of the Coronavirus. The buyers were challenged to find a new lender amidst the pandemic, after their original lender opted out of the transaction. Multiple extensions were granted, and the transaction was finally closed in June 2020 due to the commitment and patience of both the buyer and seller. The portfolio sold at 89% occupancy and, ultimately, received 14 offers.

“Mike and his team are deal makers. They see both the seller’s and buyer’s side on most issues and work fairly and pragmatically to figure out a solution that is a win-win for everyone. They are truly some of the most seasoned and best storage professionals/brokers in the industry. I have enjoyed every deal I have done with them and hope to do more with them.”

-Liz Schlesinger, Merit Hill Capital

We were selected to exclusively market for sale Upland Self-Storage, a self-storage facility located in Upland, California. Located at 135 South Campus Avenue in the Riverside/San Bernardino area, the facility provided an opportunity for entry into a high-barrier-to-entry market. The 70,570-square-foot building sits on 5.2 acres, and the property features 827 self-storage units with drive-up access, video monitoring, gated access and RV/boat/auto storage.

The seller approached us in October of 2019 to review and determine the feasibility of their asset as well as the optimum time to capitalize on the asset. Our team analyzed the property site and provided our assessment of the project as well as recommendations. We worked with the seller through every stage of the project, laying out a strategic plan and vision for how to maximize the value of their asset and achieve the goals they set.

Following a successful marketing process — and after only a month and a few days on the market — the property received 82 executed NDAs and 10 first-round offers. With an occupancy rate of 87%, the property sold over the asking price, for a total of $12,175,000.

“The Self-Storage Advisory Group at Cushman & Wakefield did an outstanding job in all aspects of the sale of my storage facility. I highly recommend them.”

-Bernie Svalstad, seller

The Best Self Storage Portfolio is a nine-asset portfolio in Broward County, Florida, in the Fort Lauderdale area. The seller, a private, high-net-worth individual, retained us as exclusive advisor for the sale. The quality and size of the assets, along with their geographic concentration, presented challenges to the buyer pool for the assets.

After a 15-year relationship, the seller approached us to explore a potential disposition of all nine of the storage assets. Our team flew out and did a full audit on the portfolio — analyzing not only current operations but also how the portfolio functioned as a whole — and delivered a baseline analysis with points to improve upon. Our strategic analysis included a recommendation to make significant changes in operations and placed a current value on the portfolio of $65,000,000. Our team laid out a strategic plan spanning the next 12 months that included targeted capital improvements, marketing initiatives and consistent updates. The seller engaged our team and executed on our strategy.

Following a successful marketing process that targeted institutional funds, large operators and PE firms, our team received 120 executed NDAs and nine total offers, ultimately transacting for over $90,000,000.

“Mike and his team took the necessary steps to ensure that it was a simplistic, smooth transaction. Mike and his team operate with confidence and expertise, and I was truly pleased with their dedication and constant focus throughout every step in the transaction.”

-Arvid Albanese

Our recent sales reflect the breadth and depth of our portfolio — and our commitment to our clients’ success.

We are the leading source for self-storage real estate advisory services, information, valuation and research.